Bankruptcy And Mortgage Law Center

Overview:

Open Hours:

Introduce

Navigating significant financial challenges can be one of the most stressful periods in anyone's life. When debt becomes overwhelming, or the threat of foreclosure looms over your home, knowing where to turn for clear, effective legal guidance is crucial. For residents across Maryland, the Bankruptcy And Mortgage Law Center in Gaithersburg stands as a dedicated legal resource, committed to helping individuals and families find a path toward financial stability and a fresh start.

The attorneys at the Bankruptcy And Mortgage Law Center understand the immense pressure and anxiety that financial distress can bring. They approach each client's situation with compassion and a deep understanding of bankruptcy and mortgage law. Their goal is not just to process paperwork, but to genuinely guide you through complex legal procedures, explaining your options in plain language and empowering you to make informed decisions for your future. Whether you're considering Chapter 7 or Chapter 13 bankruptcy, or seeking ways to save your home from foreclosure, this firm offers the expertise and support you need.

The U.S. bankruptcy law is designed to provide a "fresh start" for debtors while also ensuring a fair process for creditors. It's a constitutional right, not a source of shame. The Bankruptcy And Mortgage Law Center embraces this principle, working tirelessly to help clients eliminate qualifying debts, protect essential assets, and prevent wage garnishments or creditor harassment. They are well-versed in the nuances of federal bankruptcy code, including the various chapters, and how they apply to specific financial situations.

While specific testimonials for the "Bankruptcy And Mortgage Law Center" in Gaithersburg, MD, were not immediately available in the provided data, general client reviews for similar bankruptcy law centers across the country often highlight attributes such as compassionate support, clear communication, and proven results. Clients frequently express immense relief and gratitude for attorneys who are knowledgeable, responsive, and provide tailored solutions, helping them to feel less overwhelmed and more confident about their financial recovery journey. It is reasonable to infer that a firm specializing in such critical areas would prioritize these qualities to effectively serve its clients.

When financial burdens feel insurmountable, the Bankruptcy And Mortgage Law Center offers a beacon of hope, providing the legal acumen and dedicated support necessary to help Maryland residents reclaim their financial lives.

The Bankruptcy And Mortgage Law Center is conveniently located at 931 Russell Ave Suite B, Gaithersburg, MD 20879, USA. Situated in the vibrant city of Gaithersburg, within Montgomery County, this location offers excellent accessibility for individuals and families across Maryland. Gaithersburg is a well-connected area with a robust road network, making it straightforward for clients to reach the office from various parts of the state.

For those traveling by car, the office is positioned near major routes, allowing for easy navigation from neighboring communities such as Rockville, Germantown, Bethesda, and Frederick. While specific parking details for this exact address are not provided, commercial buildings in Gaithersburg typically offer adequate parking options, aiming to ensure a hassle-free visit for clients. This accessibility helps reduce any additional stress associated with seeking legal assistance during a challenging financial period.

Furthermore, Gaithersburg is served by public transportation. Although direct public transport links to the immediate vicinity of the office would need to be verified, the city has a robust bus system (Ride On) that connects to Metro stations (Shady Grove, Rockville, Gaithersburg), offering alternatives for clients who rely on public transit. The firm's location within a professional suite also ensures a discreet and comfortable environment for confidential discussions about sensitive financial matters. Being deeply rooted in the Montgomery County area, the Bankruptcy And Mortgage Law Center is well-positioned to serve the local community effectively, understanding regional nuances that may impact bankruptcy and mortgage cases.

The Bankruptcy And Mortgage Law Center specializes in critical legal areas designed to help Maryland residents overcome significant financial difficulties. Their focus is on providing pathways to debt relief and protecting assets, particularly homes.

Chapter 7 Bankruptcy Services: This option offers a "fresh financial start" by allowing individuals to eliminate qualifying unsecured debts, such as credit card debt, medical bills, and personal loans, typically within a few months. The firm guides clients through the liquidation process while helping to protect valuable property through exemptions.

Chapter 13 Bankruptcy Support: For individuals with regular income who want to reorganize their debts, Chapter 13 provides a structured repayment plan over three to five years. This can be particularly beneficial for catching up on mortgage payments, protecting assets, and creating a more manageable budget, often stopping foreclosure proceedings in the process.

Foreclosure Prevention: The firm specializes in using bankruptcy protection, particularly Chapter 13, to stop foreclosure proceedings. By filing for bankruptcy, an "automatic stay" is imposed, which temporarily halts creditor actions, including foreclosure, allowing clients time to explore options for keeping their home and getting back on track with mortgage payments.

Creditor Harassment Protection: Filing for bankruptcy imposes an automatic stay, which legally stops debt collectors from making harassing calls, preventing wage garnishments, and halting other collection activities. The firm ensures clients' rights are protected under the Fair Debt Collection Practices Act.

Debt Settlement and Relief: Beyond formal bankruptcy filings, the firm may assist clients in negotiating with creditors to settle or restructure outstanding debts, aiming for solutions outside of court when appropriate.

Loan Modification: Assistance with seeking loan modifications while a bankruptcy proceeding is pending, aiming to help clients get back in control of their mortgage and prevent foreclosure by potentially securing a new interest rate or lower monthly payments.

Protecting Assets / Exemptions: Guiding clients on how to utilize bankruptcy exemptions to safeguard essential assets, including vehicles and personal property, throughout the bankruptcy process.

Strategic Financial Planning: Developing personalized plans to address specific financial challenges and create a clear path toward long-term financial recovery, potentially including guidance on rebuilding credit after bankruptcy.

The Bankruptcy And Mortgage Law Center distinguishes itself through several key features that benefit Maryland residents facing financial distress:

Specialized Expertise: The firm focuses specifically on bankruptcy and mortgage law, providing in-depth knowledge and experience in these complex areas. This specialization ensures clients receive highly focused and effective legal strategies tailored to their unique financial situations.

Comprehensive Debt Relief Solutions: Beyond just filing for bankruptcy, the firm offers a range of debt relief options, including Chapter 7, Chapter 13, foreclosure prevention, and debt negotiation, allowing for a customized approach to financial recovery.

Foreclosure Protection: A major highlight is their ability to leverage bankruptcy laws to stop foreclosure proceedings immediately through the automatic stay, providing homeowners with crucial time and options to save their homes.

Creditor Harassment Cessation: Clients can find immediate relief from persistent and stressful creditor calls and wage garnishments once a bankruptcy petition is filed, as the automatic stay legally halts these collection efforts.

Compassionate and Supportive Guidance: Although specific testimonials for this firm were not provided, firms specializing in bankruptcy typically emphasize compassionate support, recognizing the emotional toll of financial struggles. They aim to make the process as clear and stress-free as possible.

Asset Protection Focus: The firm works diligently to help clients understand and utilize bankruptcy exemptions to protect their valuable assets, such as homes and vehicles, during the bankruptcy process.

Guidance on Financial Rebuilding: Beyond the immediate legal steps, the firm likely provides advice on rebuilding credit and re-establishing financial stability post-bankruptcy, helping clients prepare for a healthier financial future.

Located in Gaithersburg, MD: A local presence means accessibility for Maryland residents, coupled with an understanding of state-specific laws and local court procedures relevant to bankruptcy and mortgage cases.

While professional legal services like the Bankruptcy And Mortgage Law Center typically do not offer "promotions" in the commercial sense, they often provide a crucial benefit that acts as a valuable special offer for those facing financial hardship:

Free Initial Consultation: It is a common practice among bankruptcy law firms to offer a complimentary initial consultation. This allows prospective clients to meet with an attorney, discuss their financial situation and legal options (such as Chapter 7, Chapter 13, or foreclosure prevention), and receive preliminary advice without any upfront cost or obligation. This is an invaluable opportunity for Maryland residents to gain clarity on their financial challenges and understand the potential pathways to a fresh start before committing to legal services. It is highly recommended to contact the Bankruptcy And Mortgage Law Center directly to confirm their policy regarding initial consultations.

For Maryland residents seeking expert legal guidance on bankruptcy, mortgage issues, and debt relief, the Bankruptcy And Mortgage Law Center is ready to assist.

Address: 931 Russell Ave Suite B, Gaithersburg, MD 20879, USA

Phone: (301) 670-9787

Mobile Phone: +1 301-670-9787

Don't hesitate to reach out to schedule a consultation and begin your journey toward financial freedom.

For Maryland residents grappling with overwhelming debt, the threat of foreclosure, or other severe financial challenges, the Bankruptcy And Mortgage Law Center in Gaithersburg offers a highly suitable and invaluable resource. Its specialized focus, accessible location, and commitment to client well-being make it an ideal partner for navigating the complexities of financial recovery.

The firm's core suitability for locals stems from its dedicated expertise in bankruptcy and mortgage law. In a time of profound stress, having attorneys who are deeply knowledgeable about Chapter 7 and Chapter 13 bankruptcies, as well as strategies to stop foreclosure, provides immense relief. This specialization ensures that clients in Maryland receive precise, up-to-date legal advice tailored to their specific financial circumstances, helping them understand the nuances of federal and state laws that govern their situation. Their ability to immediately implement an "automatic stay" to halt creditor harassment and foreclosure proceedings offers vital protection and peace of mind when it’s needed most.

Located in Gaithersburg, within Montgomery County, the Bankruptcy And Mortgage Law Center is geographically convenient for a significant portion of Maryland's population. Easy access via major roads and proximity to public transportation options (such as the Metro and Ride On bus services in the broader Gaithersburg area) means that residents from various parts of the state can readily reach their office. This local presence not only provides logistical convenience but also suggests a familiarity with the local legal landscape, including court procedures and community resources relevant to financial distress.

Furthermore, while direct client testimonials for this specific firm were not provided, the nature of bankruptcy law requires compassionate and clear communication. A firm specializing in this area typically prioritizes guiding clients through what can be an emotionally taxing process with empathy and understanding. The commitment to helping individuals achieve a "fresh financial start" underscores a client-centered approach that seeks to empower people to rebuild their lives, rather than merely addressing legal technicalities.

For Marylanders seeking a pathway out of financial hardship, the Bankruptcy And Mortgage Law Center offers not just legal solutions, but also the support and guidance necessary to regain control of their financial future. By providing specialized expertise, practical solutions like foreclosure prevention, and an accessible local presence, it stands as a crucial resource for any resident ready to embark on their journey to debt relief and stability.

Location & Map

931 Russell Ave Suite B, Gaithersburg, MD 20879, USA

Customer Reviews

(0 reviews)

More Laywer Nearby

Waseem Law Group, PLLC

931 Russell Ave STE C, Gaithersburg, MD 20879, USA

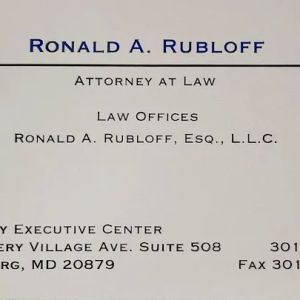

Law Offices of Ronald A. Rubloff Esq.

6 Montgomery Village Ave suite 508, Gaithersburg, MD 20879, USA

Burgos & Burgos, LLC

6 Montgomery Village Ave Suite 500, Gaithersburg, MD 20879, USA

The Yolles Legal Group

6 Montgomery Village Ave Suite 401, Gaithersburg, MD 20879, USA

Antezana & Antezana, LLC

18310 Montgomery Village Ave #600, Gaithersburg, MD 20879, USA

Immigration Legal Advisors, PLLC

18516 Office Park Dr, Montgomery Village, MD 20886, USA

The Law Office of Alex Radice - Oficina Legal de Alex Radice

702 Russell Ave Suite 470A, Gaithersburg, MD 20877, USA

Stouffer Legal

481 N Frederick Ave #102, Gaithersburg, MD 20877, USA

Berman | Sobin | Gross LLP - Gaithersburg Work Injury Lawyers

481 N Frederick Ave #300, Gaithersburg, MD 20877, USA

Law offices of Elling & Elling

443 N Frederick Ave, Gaithersburg, MD 20877, USA

Jay S. Horowitz, P.C.

7 Brookes Ave #103, Gaithersburg, MD 20877, USA

Glinsmann Immigration

12 Russell Ave, Gaithersburg, MD 20877, USA