Defense Tax Partners - Tax Attorneys, IRS Tax Relief Settlement, Free Consultation

Open Hours:

Monday, 8:00 AM - 8:00 PM

Tuesday, 8:00 AM - 8:00 PM

Wednesday, 8:00 AM - 8:00 PM

Thursday, 8:00 AM - 8:00 PM

Friday, 8:00 AM - 8:00 PM

Saturday, 8:00 AM - 8:00 PM

Sunday, Closed

Introduce

Hello, Maryland neighbors! If you’ve ever found yourself overwhelmed by tax debt, receiving daunting letters from the IRS, or simply unsure how to navigate the complex world of tax regulations, you know how stressful and daunting it can be. For many in our community, finding reliable and effective assistance is crucial. This is where Defense Tax Partners - Tax Attorneys, IRS Tax Relief Settlement, Free Consultation comes in. Located right here in Bethesda, Defense Tax Partners offers specialized legal services designed to help individuals and businesses resolve their tax problems and regain financial peace of mind.

In this comprehensive guide, we'll introduce you to Defense Tax Partners, outlining their location, the wide array of services they provide, and what truly sets them apart as a trusted resource for tax relief in Maryland. Whether you’re dealing with unfiled tax returns, wage garnishments, or simply need expert advice on managing your tax obligations, understanding the support available from Defense Tax Partners can be your first step towards a solution. Their approach is not just about solving immediate problems, but also about equipping you with the knowledge to avoid future pitfalls, as highlighted by satisfied local clients.

Many Maryland residents have found themselves in challenging tax situations due to various circumstances, from unexpected financial setbacks to misunderstandings of tax law. The burden of tax debt can impact every aspect of life, leading to sleepless nights and immense stress. Defense Tax Partners understands these challenges deeply and aims to alleviate that burden with professional, compassionate, and effective legal strategies. Let's delve into what makes them a go-to firm for tax relief right here in our community.

For those in Maryland seeking assistance with tax issues, the convenience of a firm’s location is paramount. Defense Tax Partners is ideally situated at 3 Bethesda Metro Center #660, Bethesda, MD 20814, USA. This address places them in a highly accessible and central location within Montgomery County, making it convenient for residents across Maryland to reach their offices.

The Bethesda Metro Center is a significant advantage. Being directly connected to the Washington Metro's Red Line, with the Bethesda station on-site, means that clients can easily access the firm via public transportation. This is particularly beneficial for those who prefer not to drive or are coming from various parts of the DC metropolitan area, including other Maryland counties like Prince George's or Frederick, as well as those commuting from Washington D.C. itself. For individuals who do drive, the location in Bethesda offers numerous parking options, both public and private, within close proximity to the office building.

This central location not only ensures ease of access but also positions Defense Tax Partners within a professional and reputable commercial hub. The surrounding area boasts various amenities, providing a comfortable and convenient experience for clients before or after their appointments. The strategic choice of a Bethesda location reflects Defense Tax Partners' commitment to serving the Maryland community with readily available and high-quality tax relief services. They understand that when you're dealing with sensitive financial matters, a straightforward and stress-free journey to their office is part of providing excellent customer service.

The ease of reaching Defense Tax Partners means less hassle for you when you’re already dealing with the complexities of tax problems. This thoughtful consideration for client convenience is a testament to their dedication to supporting Maryland locals effectively and efficiently.

Defense Tax Partners specializes in a wide range of tax resolution services, designed to address various issues individuals and businesses may face with the IRS and state tax authorities. Their team of tax attorneys is equipped to handle complex cases and negotiate on your behalf. Here are some of the key services they offer:

-

IRS Tax Relief Settlements (Offer in Compromise - OIC): This is a primary service where Defense Tax Partners helps clients settle their tax debt for a fraction of the amount owed. They assess your ability to pay, income, expenses, and asset equity to negotiate a favorable settlement with the IRS, potentially saving you a significant amount of money.

-

Prevention and Release of Wage Garnishments: If the IRS is garnishing your wages, Defense Tax Partners can work quickly to stop these actions and prevent future garnishments, allowing you to regain control of your earnings.

-

Prevention and Release of Bank Levies: Similar to wage garnishments, they intervene to prevent or remove bank levies, protecting your bank accounts from being seized by the IRS.

-

Removal of IRS Tax Liens: Tax liens can severely impact your credit and property. Defense Tax Partners works to get these liens removed, helping to clear your financial record and protect your assets.

-

Resolution of Unfiled Tax Returns: For those with multiple years of unfiled tax returns, the firm can help get you back into compliance, preparing and filing past-due returns and addressing any penalties or interest.

-

Penalty Abatement: They can help reduce or eliminate penalties and interest charges imposed by the IRS, often a significant portion of a taxpayer’s overall debt.

-

Installment Agreements: If an Offer in Compromise isn't suitable, Defense Tax Partners can negotiate manageable payment plans with the IRS, allowing you to pay off your debt over time without aggressive collection actions.

-

Tax Audit Representation: Should you face an IRS audit, their attorneys can represent you throughout the process, ensuring your rights are protected and helping to navigate the complexities of the audit.

-

Payroll and Sales Tax Resolution: For businesses struggling with payroll or sales tax liabilities, Defense Tax Partners offers specialized solutions to resolve these critical debts and avoid further penalties.

By offering such a comprehensive suite of services, Defense Tax Partners ensures that they can address almost any tax-related challenge, providing Maryland clients with expert guidance and effective solutions.

Defense Tax Partners distinguishes itself through several key features and highlights that are particularly beneficial for Maryland residents facing tax challenges:

-

Expertise in Tax Law: The firm boasts a team of dedicated tax attorneys and professionals with extensive experience in federal and state tax laws. This specialized knowledge is crucial for navigating the intricate and often intimidating world of the IRS and state tax authorities, ensuring clients receive highly informed and strategic advice. Their combined experience, often cited as over 50 years, signifies a deep understanding of tax regulations and resolution strategies.

-

Client-Centric Approach and Great Customer Service: Real customer reviews consistently highlight "great customer service" and a "sense of relief" when working with their agents. Clients appreciate feeling understood and supported, especially when dealing with stressful financial situations. This client-first philosophy means personalized attention and clear communication throughout the resolution process.

-

Empowering Clients with Knowledge: Beyond resolving immediate tax problems, Defense Tax Partners focuses on educating their clients. As one reviewer mentioned, "not only did they help me turn around but they gave me the knowledge to take home so I wouldn’t make the same mistakes." This commitment to empowering clients with financial literacy helps prevent future tax issues.

-

Proven Track Record of Turning Situations Around: Testimonials speak to their ability to help clients who were "upside down and owing" to "turn around." This demonstrates their effectiveness in achieving positive outcomes for individuals burdened by significant tax debt. Their goal is to help clients settle tax debt for a fraction of what is owed, providing substantial financial relief.

-

Free Consultation Offered: A significant advantage for potential clients is the availability of a free consultation. This allows individuals to discuss their specific tax situation with an expert without any initial financial commitment, providing a risk-free opportunity to understand their options and how Defense Tax Partners can help. This initial step is crucial for building trust and assessing compatibility.

-

Comprehensive Problem Solving: Defense Tax Partners isn't just about quick fixes. They aim for holistic solutions that not only resolve current tax problems but also address the underlying issues, helping clients move towards long-term financial stability. This includes preventing wage garnishments, bank levies, and removing tax liens, which can have devastating impacts on an individual's financial health.

These features collectively make Defense Tax Partners a strong choice for Maryland residents seeking professional, empathetic, and effective assistance with their tax challenges.

Defense Tax Partners clearly highlights a significant promotion that is highly beneficial for potential clients: a Free Consultation. This offer is explicitly mentioned in their business name and is a standard practice for the firm.

A free consultation provides an invaluable opportunity for Maryland residents to:

-

Discuss Their Tax Situation Without Obligation: You can openly explain your specific tax problems, whether it's unfiled returns, IRS notices, wage garnishments, or overwhelming tax debt, to an experienced tax professional.

-

Receive Initial Assessment and Guidance: During the consultation, the attorneys at Defense Tax Partners can provide an initial assessment of your situation and explain the potential strategies and tax relief options available to you, such as an Offer in Compromise, Installment Agreement, or Penalty Abatement.

-

Understand the Process: This is a chance to learn about the steps involved in resolving your tax issue, what to expect, and how the firm would approach your case.

-

Determine Compatibility: It allows you to gauge the firm's customer service, professionalism, and whether you feel comfortable entrusting them with your sensitive financial matters. As indicated by customer reviews, getting a "sense of relief" when starting to work with them is a key benefit.

While the firm does not list other ongoing promotional discounts or special offers in publicly available information, the free consultation is a substantial benefit that lowers the initial barrier to seeking expert legal help for tax problems. It demonstrates their willingness to engage with potential clients and provide immediate value without financial commitment, which is crucial for individuals who are already under financial stress due to tax debt. We recommend that interested Maryland residents take advantage of this free consultation to explore their options and see how Defense Tax Partners can assist them.

Reaching out to Defense Tax Partners is straightforward for Maryland residents needing professional tax relief. Here's how you can get in touch:

-

Address: 3 Bethesda Metro Center #660, Bethesda, MD 20814, USA

-

Phone: (240) 414-4051

-

Mobile Phone: +1 240-414-4051

These contact details provide direct access to the firm, allowing you to schedule your free consultation or make any necessary inquiries. The Bethesda address offers a physical location that is convenient and accessible for many across the Maryland region. The provision of both a standard phone number and a mobile phone number ensures that communication is flexible and responsive, accommodating various client needs. When you call, be prepared to briefly describe your tax situation so that the team can direct you to the appropriate specialist and prepare for your initial consultation effectively.

For Maryland residents grappling with the complexities and stress of IRS or state tax issues, Defense Tax Partners emerges as an exceptionally suitable and highly beneficial resource. Their comprehensive suite of services, combined with their client-focused approach and accessible location, makes them a strong choice for navigating challenging tax situations.

Firstly, their specialization in tax law and IRS tax relief settlements is precisely what many in Maryland need. Tax codes are notoriously intricate, and attempting to resolve issues with the IRS or state tax authorities without expert guidance can lead to further complications and financial strain. Defense Tax Partners’ attorneys possess the deep knowledge and negotiation skills required to effectively tackle problems like wage garnishments, bank levies, tax liens, unfiled returns, and the crucial Offer in Compromise. This focused expertise means that Maryland locals can trust that their case is handled by professionals who understand the nuances of tax law and are dedicated to securing the best possible outcome. They offer a lifeline for those who feel "upside down and owing," helping them to turn their financial situation around.

Secondly, the firm’s commitment to exceptional customer service and client empowerment resonates strongly with the needs of individuals under financial pressure. As highlighted by satisfied clients, Defense Tax Partners doesn't just process paperwork; they build trust and provide a "sense of relief." This involves clear communication, personalized attention, and, importantly, imparting knowledge that helps clients avoid similar mistakes in the future. For Marylanders who may feel intimidated by the IRS, having a supportive and informative partner who prioritizes their understanding and long-term financial health is invaluable. This goes beyond mere legal representation; it’s about providing genuine support and education.

Finally, the strategic location in Bethesda, MD, with easy access via the Metro and major roadways, underscores their commitment to serving the Maryland community. Accessibility is a key factor when dealing with sensitive and time-consuming legal matters. This convenient location ensures that residents from various parts of Maryland can reach their offices without undue burden, making the process of seeking and receiving tax relief as smooth as possible.

In essence, Defense Tax Partners offers more than just legal services; they provide a pathway to peace of mind for Maryland residents burdened by tax debt. Their blend of specialized expertise, compassionate client care, educational approach, and convenient location makes them an ideal choice for anyone in our community seeking effective and trustworthy assistance with their tax problems. If you're a Maryland local facing tax challenges, reaching out to Defense Tax Partners for their free consultation could be the most important step you take towards financial freedom and stability.

Location & Map

3 Bethesda Metro Center #660, Bethesda, MD 20814, USA

Customer Reviews

(30 reviews)

I was referred to Defense Tax Partners by a coworker and I must say they had great customer service. Not knowing who you’re able to trust these days I got a sense of relief when I started working with the agent. I went in upside down and owing now not only did they help me turn around but they gave me the knowledge to take home so I wouldn’t make the same mistakes. Thank you again and I will continue to recommend you all to family and friends!

Had a great experience with this company! I was recommended by a friend & was not disappointed! Will be coming to them next tax season!

They helped me out of a serious bond. Went above and beyond to help me fix my tax problems! Extremely satisfied! Highly recommended!

Great service! They helped me get my taxes in order and will likely use their services for any other taxes related issues

I’m satisfied with the service they took care of me tax issue quickly plus they are very affordable I recommend them

More Laywer Nearby

The McKeon Law Firm

3 Bethesda Metro Center STE 700, Bethesda, MD 20814, USA

Delia Law P.C.

3 Bethesda Metro Center #700, Bethesda, MD 20814, USA

Law Office of Ana Ochoa Cohen

3 Bethesda Metro Center Suite 700, Bethesda, MD 20814, USA

Trow & Rahal, P.C.

3 Bethesda Metro Center Suite 610, Bethesda, MD 20814, USA

The Valle Law Firm, LLC

3 Bethesda Metro Center Suite 700, Bethesda, MD 20814, USA

New & Lowinger PC

2 Bethesda Metro Center #400, Bethesda, MD 20814, USA

JDKatz, P.C.

4800 Montgomery Ln #600, Bethesda, MD 20814, USA

Feldman Jackson, PC: Darryl Feldman

7600 Wisconsin Ave, Bethesda, MD 20814, USA

Reiser Deborah E

7600 Wisconsin Ave STE 700, Bethesda, MD 20814, USA

Offit Kurman

7501 Wisconsin Ave Suite 1000W, Bethesda, MD 20814, USA

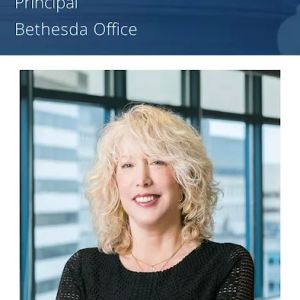

Lisa Seltzer Becker

7501 Wisconsin Ave Suite 1000W, Bethesda, MD 20814, USA

Webb Soypher McGrath

7501 Wisconsin Ave Suite 1010W, Bethesda, MD 20814, USA