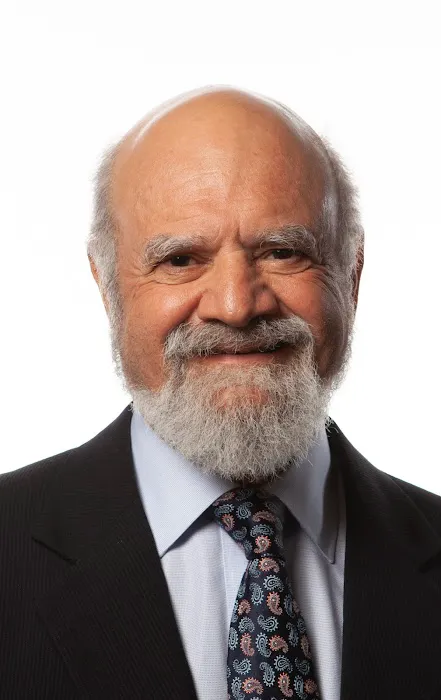

Robert L. Sommers - Attorney at Law

Open Hours:

Monday, Closed

Tuesday, 10:00 AM - 5:00 PM

Wednesday, 10:00 AM - 5:00 PM

Thursday, 10:00 AM - 5:00 PM

Friday, Closed

Saturday, Closed

Sunday, Closed

Introduce

### Introduction / Overview

In the complex world of taxation, whether you're dealing with the IRS, navigating international assets, or planning for your estate, expert legal guidance is not just beneficial—it's often essential. For individuals and small businesses throughout California, particularly in the San Francisco Bay Area, Robert L. Sommers - Attorney at Law stands out as a preeminent resource for all things tax-related. With a career spanning over 48 years, Robert L. Sommers is a sole practitioner who brings an encyclopedic knowledge of tax law to every client interaction.

Certified as a Tax Specialist by the California Board of Legal Specialization of the State Bar of California for 35 years, a distinction held by fewer than 0.05% of all attorneys in California, Mr. Sommers offers unparalleled expertise. He also holds a postgraduate legal degree (LL.M.) in taxation from New York University School of Law, one of the top graduate tax programs in the U.S. Beyond his impressive academic and professional credentials, clients consistently describe him as down-to-earth, easy to talk to, and exceptionally helpful, even offering valuable insights during free consultations without pushing for further engagement. His dedication lies in providing clear, actionable advice that empowers clients to move forward with confidence, demonstrating a very high level of integrity in all his dealings.

### Location and Accessibility

Robert L. Sommers - Attorney at Law is conveniently located in a prime area of San Francisco, making his office easily accessible for clients throughout the Bay Area. His office address is:

90 New Montgomery St, San Francisco, CA 94105, USA

This address places the office in the bustling Financial District, a well-connected and central part of the city. The location offers excellent accessibility via various public transportation options, including BART and Muni lines, with numerous bus stops serving the surrounding streets. For those who prefer to drive, several parking garages are available nearby. This strategic placement ensures that individuals and businesses seeking specialized tax advice can reach his office with ease, facilitating convenient consultations and meetings.

### Services Offered

Robert L. Sommers specializes in a comprehensive range of tax law services, catering to the complex needs of both domestic and international clients, as well as addressing business and estate planning matters. His extensive experience and certified specialization make him a go-to attorney for intricate tax situations. His primary service areas include:

- International Tax Law:

- Advising U.S. individuals and companies on tax implications of foreign assets and income.

- Guidance on Foreign Gifts and Trusts (Form 3520).

- Assistance with Foreign Bank Account Reporting (FBAR) requirements.

- Counsel on Streamlined Voluntary Disclosure programs for undisclosed foreign accounts.

- Tax implications for foreign individuals and companies with U.S. interests.

- Domestic Tax Planning and Strategy:

- Comprehensive tax planning for individuals and small businesses to minimize tax liabilities and optimize financial outcomes.

- Strategic advice on amending tax returns.

- Guidance on complex state tax issues, including California residency audits and challenges (e.g., related to stock or security sales after moving out of state).

- IRS / Tax Settlements and Disputes:

- Representation and negotiation with the Internal Revenue Service (IRS) and state tax authorities (like the California Franchise Tax Board - FTB).

- Assisting clients with audits, appeals, and resolving tax controversies.

- Securing favorable agreements for clients, potentially leading to lower payment amounts or extended payment periods.

- Business Law and Corporate Structure:

- Advising small companies on tax implications related to their corporate structure.

- Guidance on potential shareholder agreements for domestic and foreign entities.

- Counsel on the classification of independent contractors vs. employees to avoid tax and labor pitfalls.

- Estate Planning (Tax Aspects):

- Providing tax-focused advice related to estate planning to ensure tax-efficient transfer of assets and wealth.

- Addressing the tax implications of wills, trusts, and probate.

### Features / Highlights

Robert L. Sommers distinguishes himself through a variety of impressive features and highlights, affirming his status as a leading tax attorney in California:

- Certified Tax Specialist: For over 35 years, Mr. Sommers has been certified as a Tax Specialist by the California Board of Legal Specialization, a prestigious accreditation held by less than 0.05% of all California attorneys, signifying a truly elite level of expertise.

- Decades of Experience: With more than 48 years as a practicing attorney, Mr. Sommers brings a wealth of practical experience and historical insight into the ever-evolving landscape of tax law.

- Academic Excellence: His LL.M. in Taxation from New York University School of Law, a top-tier graduate tax program, further solidifies his foundational and advanced knowledge in the field.

- "Encyclopedic Knowledge": Clients consistently praise his deep and comprehensive understanding of various facets of tax law, particularly related to foreign assets, corporate structure, and taxation. He can rapidly identify key issues in complex scenarios.

- High Integrity and Client-Focused: Reviews highlight his high level of integrity and a client-first approach. He provides extremely useful, concrete advice, even during free consultations, without pushing for further services, which fosters immense trust.

- Down-to-Earth and Approachable: Despite his profound expertise, clients find Mr. Sommers to be very "down to earth" and "easy to talk to," making complex tax discussions less intimidating and more productive.

- Author and Columnist: Mr. Sommers is the author of the nationally recognized "Tax Prophet" website, a premier tax analysis and planning resource. He also wrote a bi-weekly tax column for the San Francisco Examiner newspaper, demonstrating his ability to explain complex tax matters clearly to a broader audience.

- IRS Experience: His experience in dealing with the IRS provides clients with confidence, as he understands how to interact with tax authorities effectively and negotiate favorable outcomes.

### Promotions or Special Offers

Robert L. Sommers provides a significant value proposition that many potential clients find incredibly beneficial: a free phone consultation. As highlighted by client testimonials, during this consultation, Mr. Sommers rapidly points out key issues, weighs pros and cons of different options, and helps clients develop a concrete plan for moving forward. This generous offering allows individuals and businesses to receive highly valuable, actionable insights on complex tax, business, or foreign asset situations without any upfront financial commitment. Clients note that he does not try to "sell" further services during this call, which reinforces his integrity and client-first approach.

While specific seasonal "promotions" are not typical for legal services, the availability of such a high-caliber, free initial consultation serves as a significant benefit, especially when dealing with potentially costly and intricate tax matters.

### Contact Information

For those in California seeking expert guidance on tax, business, or estate planning matters, reaching out to Robert L. Sommers - Attorney at Law is straightforward:

- Address: 90 New Montgomery St, San Francisco, CA 94105, USA

- Phone: (510) 920-3046

- Mobile Phone: +1 510-920-3046

It is recommended to call his office to schedule your consultation, ensuring that you can receive his dedicated attention for your specific legal inquiry.

### Conclusion: Why this place is suitable for locals

For individuals and businesses throughout California, especially within the financial hub of San Francisco, Robert L. Sommers - Attorney at Law represents an exceptionally suitable and highly recommended resource for complex tax and business legal matters. In a state known for its high taxes and intricate regulations, having access to an attorney with over four decades of experience and a rare certification as a Tax Specialist is an invaluable asset. Mr. Sommers' deep expertise in both domestic and international tax law, coupled with his practical experience with the IRS and the California Franchise Tax Board, provides locals with precise, reliable, and effective guidance.

Clients consistently highlight his "encyclopedic knowledge," high integrity, and approachable demeanor, making the daunting world of tax law less intimidating. The benefit of a free, highly insightful consultation allows Californians to gain clarity and a concrete plan of action without immediate financial pressure. Whether navigating intricate foreign asset reporting, challenging a California residency audit, or structuring a business with tax efficiency in mind, Robert L. Sommers offers not just legal advice, but a trusted and highly competent partner dedicated to achieving the best possible outcomes for his local clientele.

Location & Map

90 New Montgomery St, San Francisco, CA 94105, USA

Customer Reviews

(5 reviews)

We did a phone consultation with Bob about a complicated business situation involving a potential shareholder agreement for a foreign company. He very rapidly pointed out the key issues that we should be focusing on, weighing the pros and cons of different options. This gave us a concrete plan for how to move forward. We he told us was extremely useful and he did this all for free! He didn't try to sell us on using him any further, quite the opposite. Bob demonstrated a very high level integrity and an encyclopedic knowledge of law related to foreign assets, corporate structure, and taxation. He's also very down to earth and easy to talk to. I strongly recommend him without any hesitation!

I needed a tax attorney with IRS experience for my situation. Bob quickly responded to my call for help after I sent him an e-mail. His quick and confident assessment of my situation eased my mind immediately. I felt in good hands. I recommend Mr. Sommers for all tax matters.

I inquired Mr. Sommers for consultation. He returned my call promptly and answered my questions very clearly and put my mind in ease. Mr. Sommers is not only very knowledgable, experienced and detail oriented, but also generous with his time, compassionate and very kind. I'm grateful to find him and will definitely using Mr. Sommers when I need tax advice.

Mr Sommers was the only one who called me back of all that I had reached out to. He was very straight-forward, informative and helpful. He gave me advice appropriate for my situation. I highly recommend his services!

Mr. Sommers is very experienced on all tax issues. He is willing to listen to you & plan everything for you before you even ask. I highly recommend Mr. Sommers for all tax matters. You just have to try him before talk to any other one.

More Laywer Nearby

Niesar & Vestal LLP

90 New Montgomery St 9th Floor, San Francisco, CA 94105, USA

Werner & Associates

90 New Montgomery St, San Francisco, CA 94105, USA

Akay Law

90 New Montgomery St FL 9, San Francisco, CA 94105, USA

Law Offices of Brian H Getz

90 New Montgomery St #1250, San Francisco, CA 94105, USA

National Housing Law Project

90 New Montgomery St #1015, San Francisco, CA 94105, USA

Stephen Eckdish, Attorney at Law

649 Mission St 5th floor, San Francisco, CA 94105, USA

John Rizvi, P.A. - The Idea Attorneys

649 Mission St 5th floor, San Francisco, CA 94105, USA

Johnston Law Group

649 Mission St 5th floor, San Francisco, CA 94105, USA

FRONTEO USA, Inc.

611 Mission St 4th floor, San Francisco, CA 94105, USA

Tafapolsky & Smith LLP

33 New Montgomery St #1400, San Francisco, CA 94105, USA

Selman Breitman LLP

33 New Montgomery St, San Francisco, CA 94105, USA

Larry H. Parker Accident Attorneys

95 3rd St 2nd Floor, San Francisco, CA 94103, USA